iRestora PLUS

- Home

- Articles

The tax system of this software works like you can have multiple fields of taxes. You can add all of those fields in your Tax Setting along with their rate. And later all of those will be populated when adding an item but you can change the rate there too if the tax rate is different for a specific item.

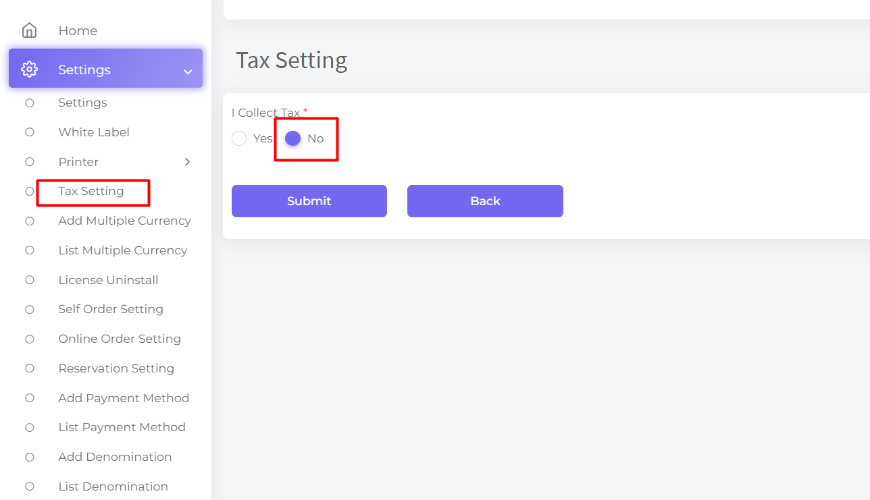

First of all, in Tax Setting “I Collect Tax”, if you select No then the system will not consider tax related any operation in the software.

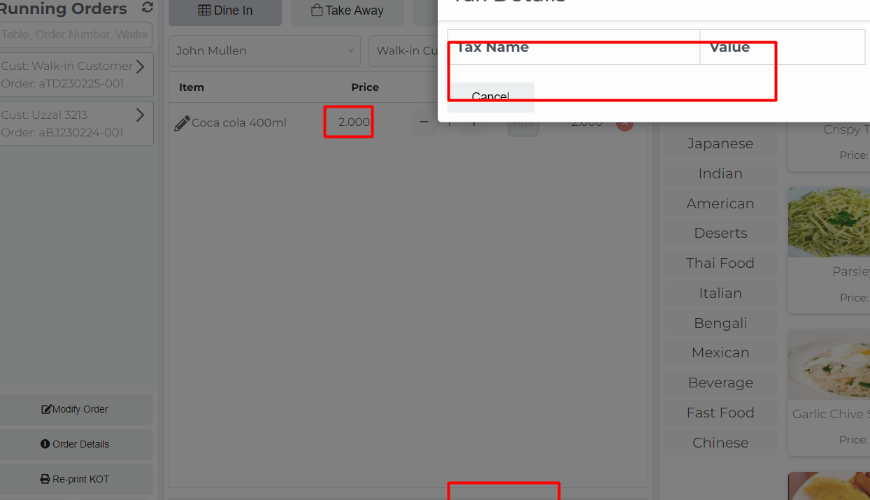

In the POS screen if we add an item in the cart then the system will consider only food menu price, no tax here due to setting.

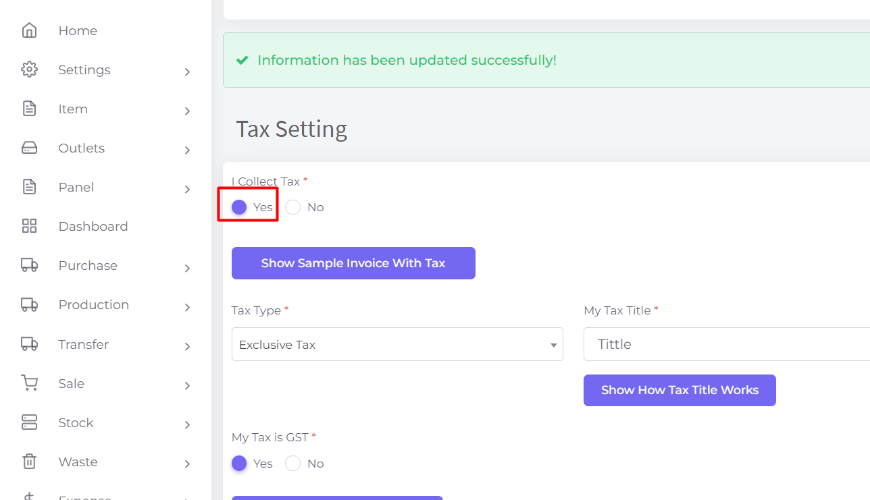

If you select Yes then the system will consider the tax related to all operations in the software.

Tax type “Exclusive Tax '' - The tax type “Exclusive” means your food price contains without tax amount and the system will consider the tax from the unit price of the food menu.

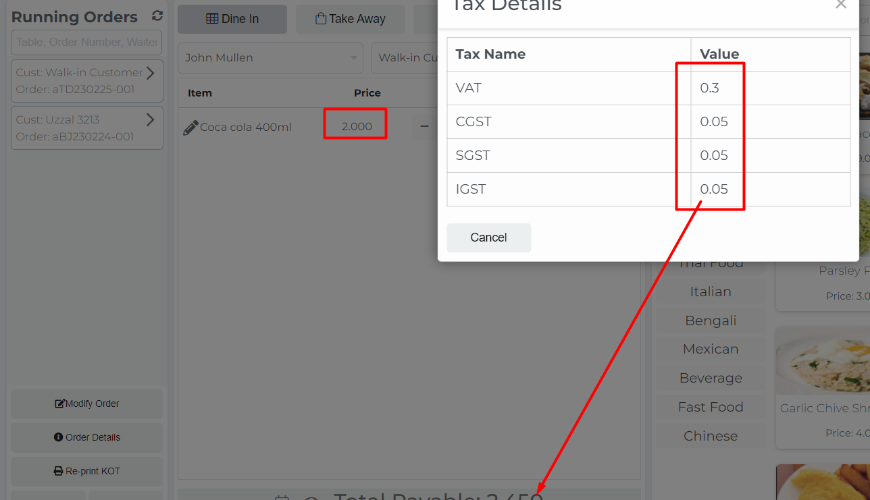

Here the main price was 2 but after tax added Total Payable is 2.450.

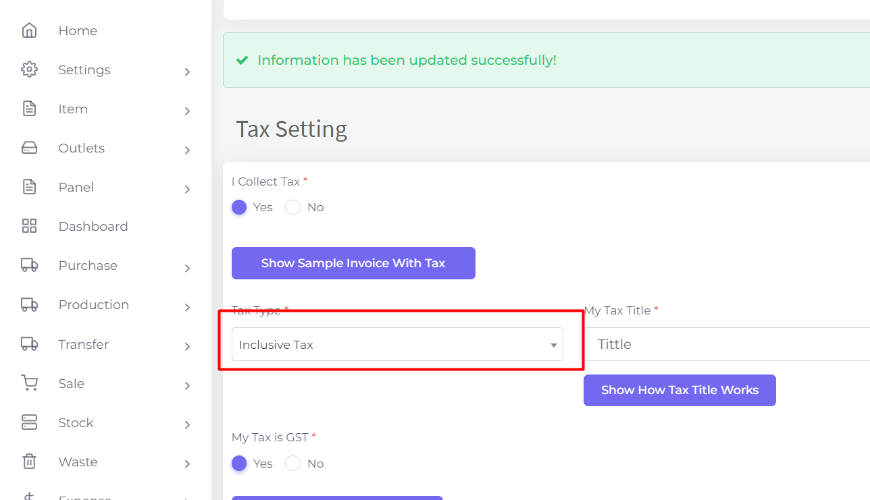

Tax type “Inclusive Tax”

The tax type “Inclusive” means your food price includes tax amount.

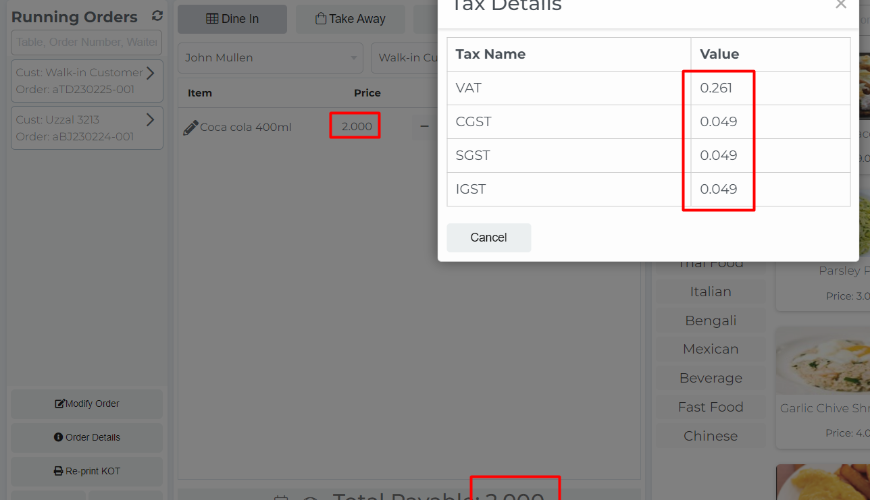

Here, tax is available but Total Payable is still 2, because the food menu is already tax included.

My Tax Title: Just write your tax title here.

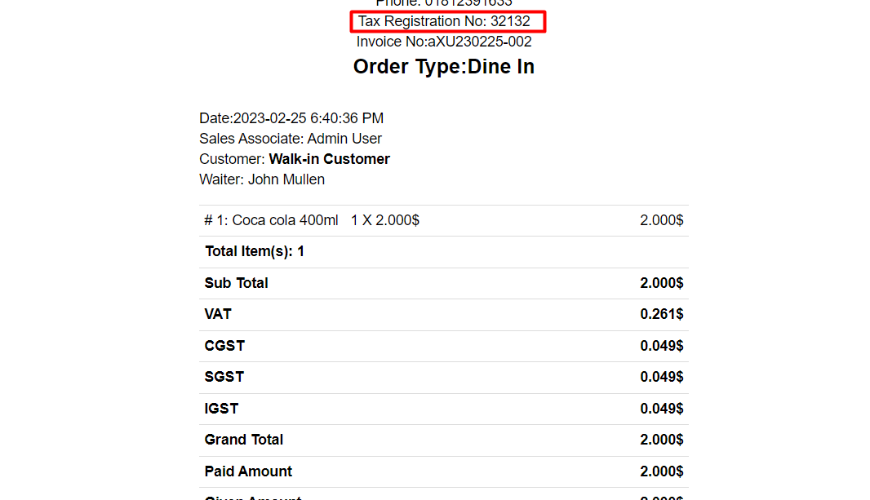

My Tax Registration No: System will show the tax registration no in invoice header.

My Tax is GST: If you are from India and your tax type is GST then enable it and fillup respective fields. In that case you will get some default tax fields like CGST, SGST, IGST and VAT. Then the tax in the software will be calculated based on Indian GST tax rules.

Was this page helpful?

Thank you for your feedback!

Please Login First

In publishing and graphic design, Lorem ipsum is a placeholder text commonly used to demonstrate the visual form of a document or a typeface without relying on meaningful content. Lorem ipsum may be used as a placeholder before final copy is available. Cookies Policy

Comments (01)

James William

08 Jun, 2024 07:51 PMThank you for this article, can you provide alternative article links here, please?